What Does Frost Pllc Mean?

What Does Frost Pllc Mean?

Blog Article

A Biased View of Frost Pllc

Table of ContentsGetting My Frost Pllc To WorkThe Of Frost PllcLittle Known Questions About Frost Pllc.Examine This Report about Frost PllcFascination About Frost Pllc

Just due to the fact that you begin in bookkeeping does not mean you have to remain in it - Frost PLLC. With many alternatives comes one more benefit of being an accountant: your abilities will certainly be suitable to a wide variety of business-related locations. Many accountancy grads have gone on to come to be Chief executive officers of successful firms after finishing accounting programsYou might go after an accountancy profession in a tiny firm or corporation; you might select to function for the government or the personal field, or you may also begin your very own business. Accountancy is at the core of the organization world, and accounting professionals possess some really solid abilities.

According to the AICPA, this is specifically real for those with accounting tasks in the nonprofit industry. Being an accountant is absolutely nothing to sneeze at. Accounting professionals are powerful. They were the just one who can reduce Al Capone. If you're seeking a respectable profession that will certainly give you with beneficial skills as well as responsibilities, accounting is a fantastic area.

A bookkeeping profession takes long years in education and learning at the very least a four-year Bachelor's degree, typically complied with by a fifth year or a Master's level.

Frost Pllc Fundamentals Explained

You'll require a great deal of decision and forward-thinking in order to be successful in this area. It is challenging to acquire admission to a prestigious audit program, and your time in university can have a crucial effect on your future profession. This is one even more factor to see to it you are getting in the field of audit for the right factors including an authentic fondness for the job.

Bureau of Labor Statistics, in their Occupational Overview Manual, indicates a solid work outlook for accounting professionals. The mean salary is affordable, and the need for these experts tends to stay steady, even in times of financial uncertainty. Accounting professionals work across a variety of a fantastic read markets and sectors, including private organizations, government firms, and public bookkeeping companies.

Some Known Details About Frost Pllc

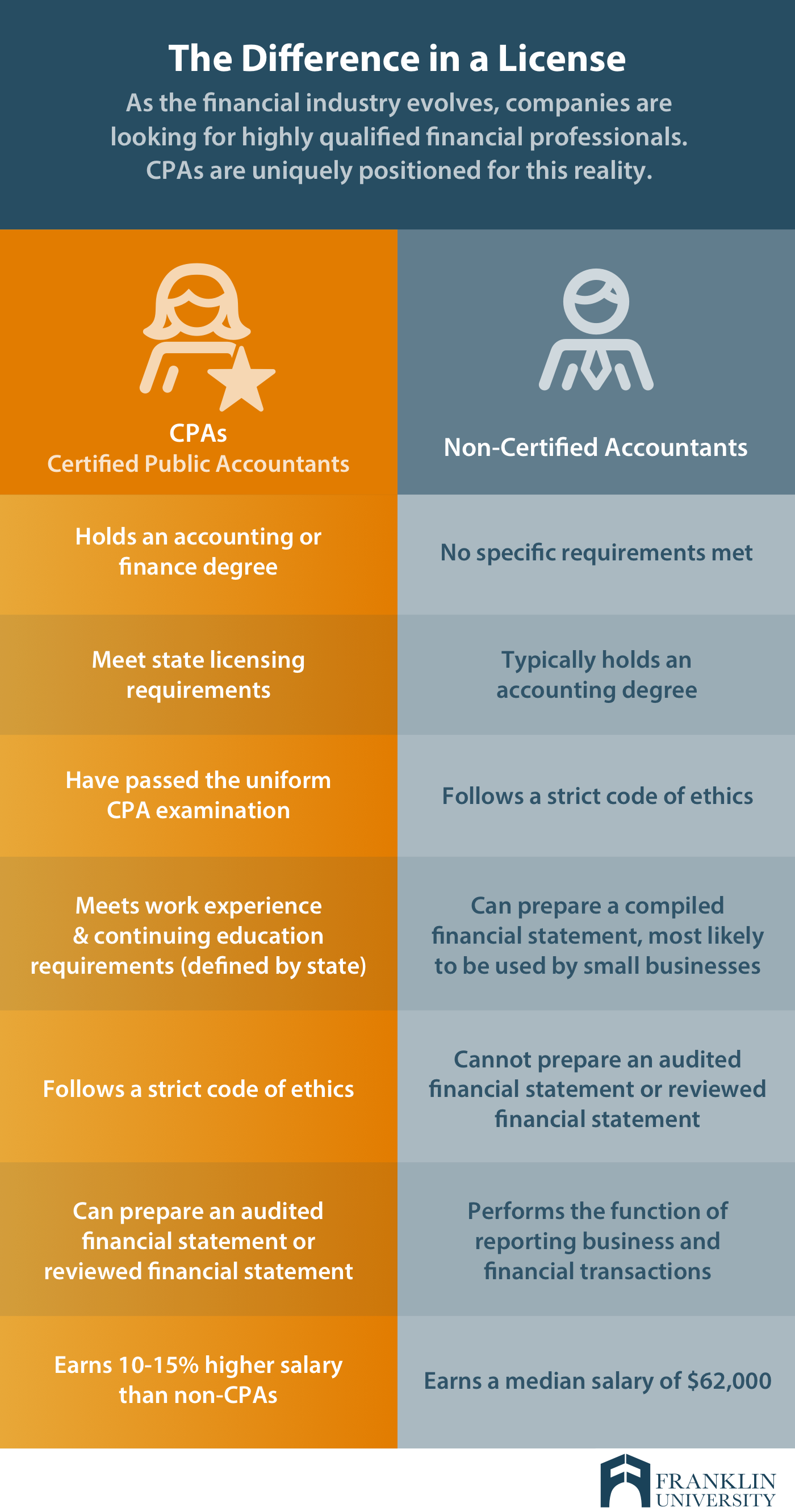

The average accounting professional's median wage has to do with $75,000. The highest-paid 25 percent of employees make much more than this, and there is the opportunity to make six numbers as an accountant. Naturally, this relies on the audit company you help, your education, and if you have a CPA accreditation.

Businesses have a whole lot on their plate that they need to deal with on a day-to-day basis. Besides making certain they have the right employees to deal with procedures, selecting brand-new advertising and marketing methods, and handling operational issues, there's always plenty to do. Managing the audit can start to get a lot more complicated as your organization expands, informative post which is why lots of businesses transform to a CPA company to manage this aspect.

They have likewise passed a CPA test that shows their proficiency in audit. Hiring a certified public accountant company can be incredibly useful to company owner who are currently overloaded with all the various other tasks involved in running a service. Hiring a CPA firm liberates their time and takes those responsibilities off their shoulders so they can that site concentrate on their various other company features.

The Main Principles Of Frost Pllc

You may enjoy to learn, however, that certified public accountant firms commonly bring a various perspective based upon their experience with functioning with other kinds of services that you might not or else obtain from an in-house group. A CPA company can maintain your financials upgraded with the current tax obligation guideline and governing adjustments that might affect them.

Firms can in fact save you throughout tax obligation season and additionally discover various other locations of your company that can be taken into consideration for cutting down expenses. A 3rd party is usually a far better resource for maintaining track of settlements, determining which expenditures are unnecessary, and assisting protect against fraud within the company. As a local business owner, you currently have a ton of work that you have to do everyday.

Among one of the most indispensable components of your business is the financials since it will tell you whether the organization is rewarding or otherwise. That's why these jobs need to be tackled with treatment and time. Working with a person else to handle these obligations will really conserve you a great deal of time.

With lots of legal issues that exist with running a business, hiring a CPA company that maintains track of your deals and activities in an appropriate manner will certainly be important if a lawful disagreement arises. They will certainly have the ability to present the proofs and ledgers when asked to do so in a deposition or court.

The Buzz on Frost Pllc

Report this page